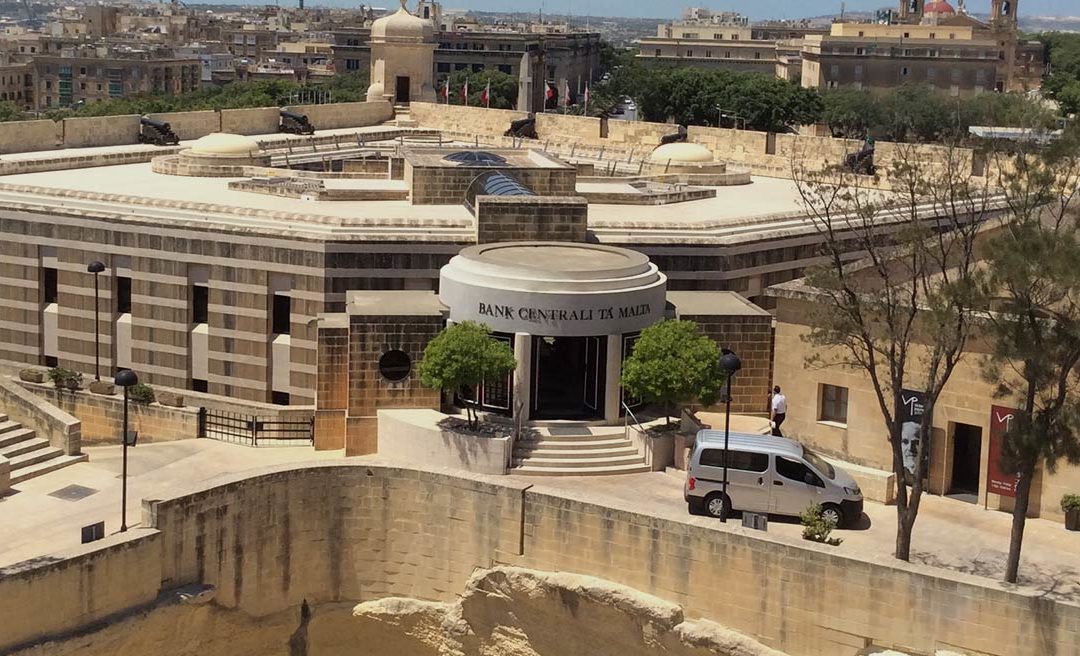

Faced with the exceptional circumstances the commercial and social sectors are being challenged with as a result of COVID 19 and the now household name Corona Virus, in the middle of April, the Central Bank of Malta intervened on local banks and issued a Directive aimed at giving breathing space to Maltese commercial entities and families alike from their credit facilities obligations.

The Central Bank issueda directive termed Moratoria on Credit Facilities in Exceptional Circumstances by virtue of Legal Notice 142 of 2020 aimed at introducing a Moratorium on Credit Facilities.

It is now possible for Borrowers who have been affected by the COVID-19 outbreak to avail themselves of a six-month moratorium on capital and interest, on their loan or overdraft facilities in Malta, subject to the eligibility criteria set out in this Directive. All retail and non-retail clients including non-financial corporates, micro, small and medium-sized enterprises, self-employed, persons in employment and households, with a credit facility who were not in arrears and were meeting their commitments prior to 1st March 2020 are eligible to benefit from this moratorium.

This Directive is not a carte blanche and Applicants have to demonstrate that their income has been or will be materially affected by the COVID-19 outbreak in such a way that it would otherwise not be possible for them to adhere to their commitments.

Applications to benefit from this scheme must be submitted before its 30th June 2020 closing date and the moratorium shall come into effect once the application is approved. The moratorium changes only the schedule of payments, whereby the duration of the credit facility shall be extended according to the length of the moratorium period.

Iuris Advocates is closely following social and economic developments as they unfold in reaction to the coronavirus pandemic. For further information on the effects of Covid-19 on the legal and business world please contact Dr. Peter Fenech or any other member of Iuris Advocates